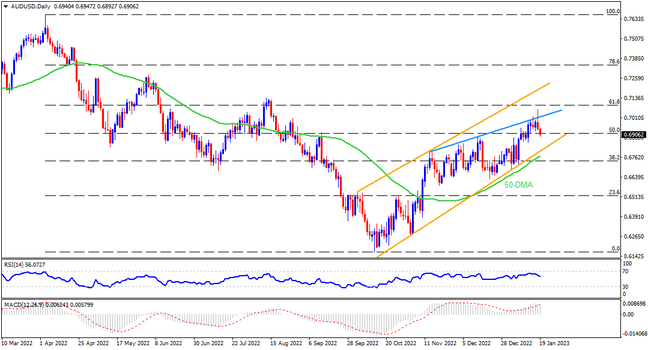

Despite the AUDUSD pair’s south-run on the downbeat Aussie jobs report, the pair trades successfully inside a 3.5-month-long upward-sloping trend channel. That said, the overbought RSI highlights beyond an ascending trend line hurdle stretched from mid-November and the 61.8% Fibonacci retracement level, respectively near 0.7015 and 0.7090 as near-term key hurdles. Following that, the August 2022 peak surrounding 0.7140 could act as the last defense of the Aussie pair sellers, a break of which could propel prices towards June’s top of 0.7282 before eyeing further advances.

Alternatively, pullback moves could aim for the aforementioned channel’s lower line, near 0.6800, as well as the 50-DMA level surrounding 0.6770. In a case where the AUDUSD price drops below 0.6770, the bearish trend could be respected, which in turn highlights the 23.6% Fibonacci retracement level near 0.6500 as the attraction for bears.

Overall, AUDUSD holds onto further upside even as the overbought RSI line hints at a pullback.

Join us on FB and Twitter to stay updated on the latest market events.