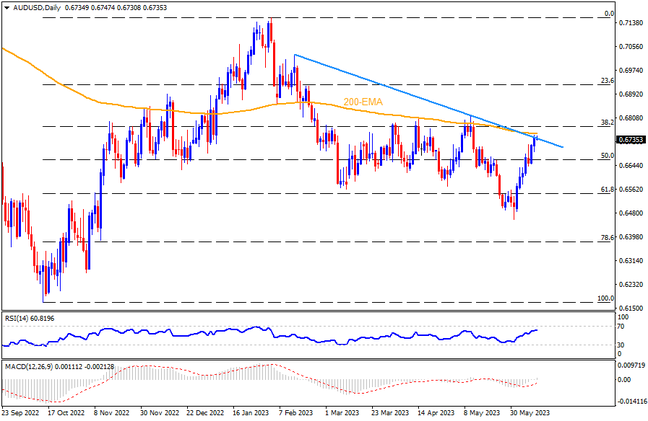

AUDUSD marked the biggest weekly gain since early November 2022, not to forget mentioning the second in a row, backed by RBA’s hawkish surprise. The Aussie pair, however, currently jostles with the key upside hurdle as the key week comprising the US inflation and Federal Reserve (Fed) monetary policy decision looms. That said, a four-month-old descending resistance line and the 200-EMA, challenge the bulls near 0.6750. Following that, the previous monthly high surrounding 0.6820 is the last stand for bears to leave before giving control to the bulls. In a case where the quote remains firmer past 0.6820, the 0.6850 and the late 2022 peak of around 0.6900 will be in the spotlight.

Meanwhile, pullback moves may initially aim for the 50% Fibonacci retracement level of the AUDUSD pair’s run-up from October 2022 to February 2023, close to 0.6660. In a case where sellers dominate past 0.6660, lows marked in April and March, respectively near 0.6570 and 0.6560, will be on their radars. It should be noted that the yearly low marked in May around 0.6455 appears the final fight for the bulls to win, if not then the pair’s southward trajectory towards a 78.6% Fibonacci retracement level of near 0.6375 can’t be ruled out.

Join us on FB and Telegram to stay updated on the latest market events.