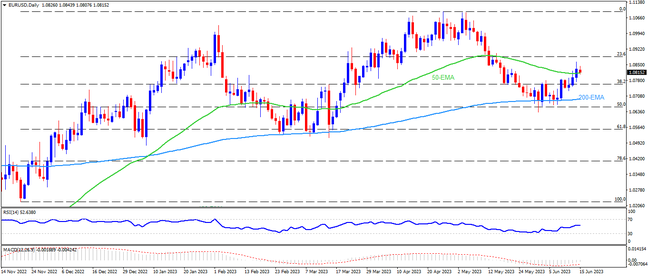

EURUSD defends recovery from 200-EMA, as well as stays above the 50-EMA hurdle, as markets prepare for the ECB. In doing so, the Euro pair lures buyers amid hawkish expectations from the European Central Bank (ECB). That said, the 23.6% Fibonacci retracement level of the pair’s upside from late November 2022 to May 2023, near 1.0900, appears immediate resistance for the bulls to watch before targeting the 1.1000 threshold. It’s worth noting, however, that the nearly overbought RSI may restrict the major currency pair’s advances past 1.1000, highlighting February’s peak of around 1.1035, as well as the yearly top marked in May around 1.1100.

On the flip side, a dovish hike from the ECB and a daily close below the 50-DMA support of 1.0810 becomes necessary to please intraday sellers of the EURUSD pair. Even so, the 200-EMA of around 1.0690 will challenge the bears. Should the pair drops below the key EMA support, the previous monthly low of around 1.0635 can act as the final defense of the Euro bulls. Following that, a southward trajectory toward the lows marked in March and January, respectively around 1.0515 and 1.0480, will be in the spotlight.

To sum up, EURUSD is likely to approach the yearly high unless the ECB disappoints.

Join us on FB and Telegram to stay updated on the latest market events.