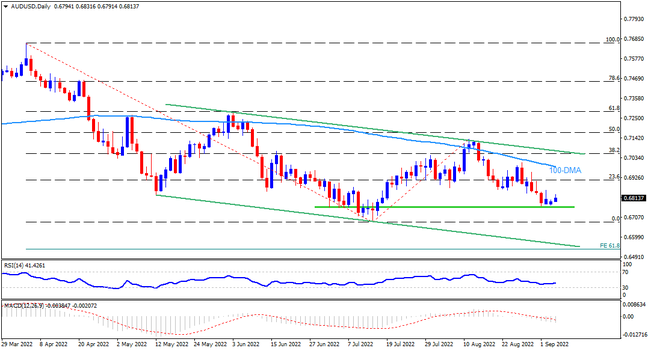

AUDUSD bears take a breather after bouncing off a two-month-old horizontal support area, inside a broad bearish channel from early May, as traders await the Reserve Bank of Australia’s (RBA) verdict. Although the Aussie central bank is up for another 0.5% rate hike, the fears of economic slowdown due to the trade links with China appear to tease the sellers. That said, a clear downside break of 0.6760 appears necessary for the sellers to approach the yearly low near 0.6680. Following that, the likely oversold RSI (14) and lower line of the stated channel, could challenge the further downside around 0.6560. Even if the quote drops below 0.6560 support, the 61.8% Fibonacci Expansion (FE) of April-August moves, near 0.6530, could act as another downside filter.

Meanwhile, recovery moves could aim for the early August low near 0.6870 before the 100-DMA hurdle surrounding 0.6990 gains the market’s attention. Should the AUDUSD bulls manage to cross the 0.6990 resistance, the 0.7000 threshold and the aforementioned bearish channel’s upper line, close to 0.7080 by the press time, will be important to watch. It’s worth mentioning that the pair’s run-up beyond 0.7080 could give control to bulls.

Join us on FB and Twitter to stay updated on the latest market events.