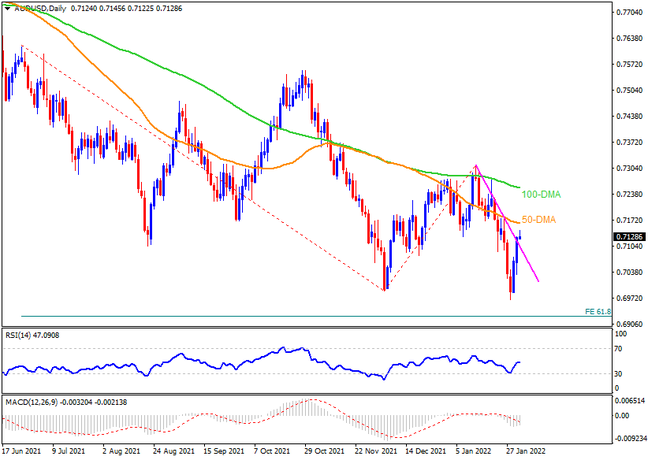

AUDUSD bulls stay hopeful as the Reserve Bank of Australia (RBA) ends QE, despite posting initial losses due to rejection of the immediate rate hike concerns. The upside momentum ignores recently cautious RBA Governor Philip Lowe’s comments while staying above a three-week-old descending resistance line, near 0.7115. That said, the 50-DMA level around 0.7170 acts as an immediate barrier for the pair to cross before directing the bulls towards the last home of bears, namely the 100-DMA level close to 0.7260.

Alternatively, pullback moves may initially aim for the 0.7000 threshold ahead of highlighting the lows marked in December 2021 and January 2022, respectively around 0.6990 and 0.6965. In a case where the AUDUSD bears keep reins past 0.6965, the 61.8% Fibonacci Expansion (FE) of mid-June 2021 to January 2022 moves, surrounding 0.6920, should gain the market’s attention.

Overall, AUDUSD bulls are up for consolidating the early 2022 losses on hawkish RBA. However, the upside momentum needs caution as the US NFP is yet to play its role.

Join us on FB and Twitter to stay updated on the latest market events.