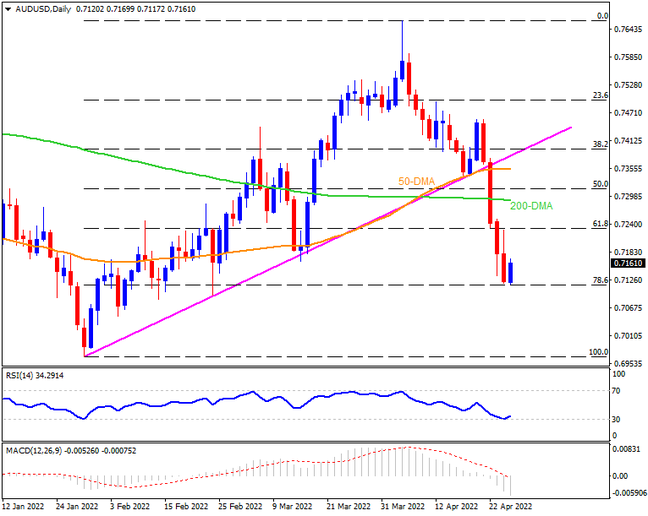

AUDUSD rebounds from a two-month low, also snapping a four-day downtrend, by cheering a strong quarterly inflation data at home. The recovery moves could also be linked to the oversold RSI and a U-turn from 78.6% Fibonacci retracement of the January-April upside. However, the Aussie remains below the key moving averages and the Fibo levels and the MACD signals are firmly bearish, which in turn suggests that the bears aren’t out of the woods. Hence, fresh selling pressure can’t be ruled out with the first support around 0.7110, comprising 78.6% Fibo. Following that, 0.7050 and the 0.7000 psychological magnet can lure the sellers ahead of directing them to the yearly low surrounding 0.6965.

Meanwhile, further recovery hinges on the pair’s ability to close beyond the previous month’s low surrounding 0.7165. Should the AUDUSD bulls manage to cross the 0.7165 hurdle, the 61.8% Fibonacci retracement level and the 200-DMA, respectively around 0.7230 and 0.7290, will be on their radar. Even so, the 50-DMA and the support-turned-resistance line from January, close to 0.7355 and 0.7385 in that order, will test the pair buyers before giving them control.

Other than the technicals, the market’s risk-off mood and firmer USD also challenge the AUDUSD buyers.

Join us on FB and Twitter to stay updated on the latest market events.