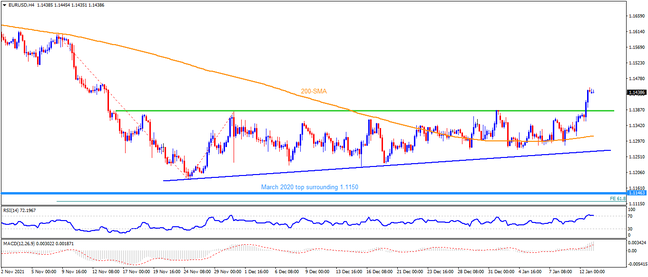

EURUSD extends the run-up beyond 200-SMA to cross a two-month-old horizontal area surrounding 1.1385 post-US inflation data. Given the price-positive signals from the MACD and RSI, the major currency pair is likely to keep the recent rebound. However, a sustained run-up beyond 1.1385 becomes necessary for the pair buyers to challenge the mid-November peak near 1.1465. Following that, the 1.1500 threshold will offer an intermediate halt during an upward trajectory towards early November’s swing highs around 1.1600.

Meanwhile, failure to stay beyond 1.1385 could trigger a pullback move targeting the 200-SMA level near 1.1310. It should be noted, however, that the EURUSD weakness past 1.1300 will be challenged by an upward sloping support line from late November, around 1.1265. Also acting as a downside filter is the year 2021 bottom close to 1.1185. In a case where the major currency pair drops below 1.1185, March 2020 high near 1.1150 and 61.8% FE of November 09-30 moves, around 1.1120, will gain the market’s attention.

To sum up, EURUSD crossed a strong hurdle to the north after the US Consumer Price Index (CPI) data but bulls seek confirmation from 1.1385.

Join us on FB and Twitter to stay updated on the latest market events.