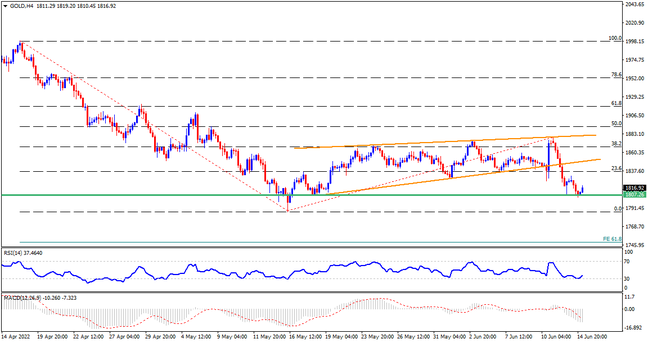

Despite bouncing off multiple troughs marked during mid-May, gold holds onto Monday’s rising wedge confirmation, suggesting further downside. However, nearly oversold RSI joins the horizontal support around $1,810 to test the intraday bears ahead of the US Federal Reserve’s (Fed) monetary policy meeting. Should the quote drops below $1,810, a downturn towards the previous monthly low surrounding $1,786 appears imminent. Following that, the 61.8% FE level near $1,750 could lure the metal sellers.

On the flip side, recovery remains doubtful until the quote rises back beyond the wedge’s support line, now resistance around $1,848. Even so, an upward sloping trend line from late May near $1,880, forming part of the bearish chart pattern, could restrict the bull’s entry. In a case where the gold prices rally beyond $1,880, the odds of witnessing a run-up towards the $1,900 threshold and then to the late April swing high surrounding $1,920 can’t be ruled out.

On a fundamental side, the Fed has already made it clear that it will announce a 50 bps rate hike but the markets have priced in a 75 bps move. If the US central bank adheres to aggressive action, the gold prices may witness further downside.

Join us on FB and Twitter to stay updated on the latest market events.