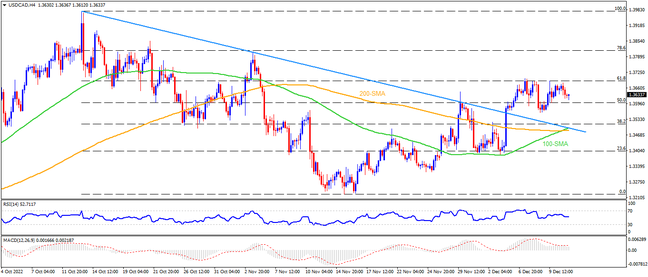

USDCAD grabbed the bull’s attention ever since it crossed a two-month-old descending resistance line, now support around 1.3500. The upside bias also takes clues from the firmer RSI and MACD. However, the 61.8% Fibonacci retracement level of the pair’s October-November downside, near 1.3695, appears a tough nut to crack for buyers. Also acting as an upside filter is the monthly high of 1.3700, a break of which could quickly propel the quote towards November’s peak surrounding 1.3805. It’s worth noting that the Loonie pair’s run-up beyond 1.3805 could aim for October’s high near 1.3980, as well as the 1.4000 psychological magnet.

Meanwhile, the 50% Fibonacci retracement level near 1.3600 restricts the USDCAD pair’s short-term downside ahead of highlighting the 1.3500 support confluence including the resistance-turned-support line from October and the 38.2% Fibonacci retracement level. Even if the pair declines below 1.3500, a convergence of 100-SMA and 200-SMA at 1.3485 appears strong support.

Overall, USDCAD is likely to rise further but the 1.3700 resistance challenges the bulls.

Join us on FB and Twitter to stay updated on the latest market events.